Canada Cpp Maximum 2024. A proactive guide to secure retirement. The maximum cpp contribution for 2024 is $3,942.45 if you are an employee.

While the 5.95% contribution rate is fixed for 2024, the maximum contribution amounts will change: The maximum pensionable earnings or year’s maximum pensionable earnings (ympe) for 2024 will be $68,500, up.

Maximizing Your Cpp Benefits In 2024:

For 2024, that means a maximum $188 in additional payroll deductions.

For 2024, The Maximum Cpp Payout Is $1,364.60 Per Month For New Beneficiaries Who Start Receiving Cpp At 65, While The Average Cpp In October 2023 Was.

The maximum pensionable earnings or year’s maximum pensionable earnings (ympe) for 2024 will be $68,500, up.

For 2024, The Maximum Pensionable Earnings Under The Canada Pension Plan (Cpp), For Employee And Employer Is 5.95% (2023:

Images References :

Source: cedarrockfinancial.com

Source: cedarrockfinancial.com

A Complete Guide to the Canada Pension Plan, For 2024, the maximum cpp payout is $1,364.60 per month for new beneficiaries who start receiving cpp at 65, while the average cpp in october 2023 was. The maximum cpp contribution for 2024 is $3,942.45 if you are an employee.

Source: insanityflows.net

Source: insanityflows.net

The CPP Max Will Be HUGE In 2024 Canada, The standard cpp rate for employees and employers is 5.95% and 11.9% for self. Employee and employer cpp contribution rates for 2024 remain at 5.95%, and the maximum contribution will be $3,867.50 each—up from $3,754.45 in 2023.

Source: www.canada.ca

Source: www.canada.ca

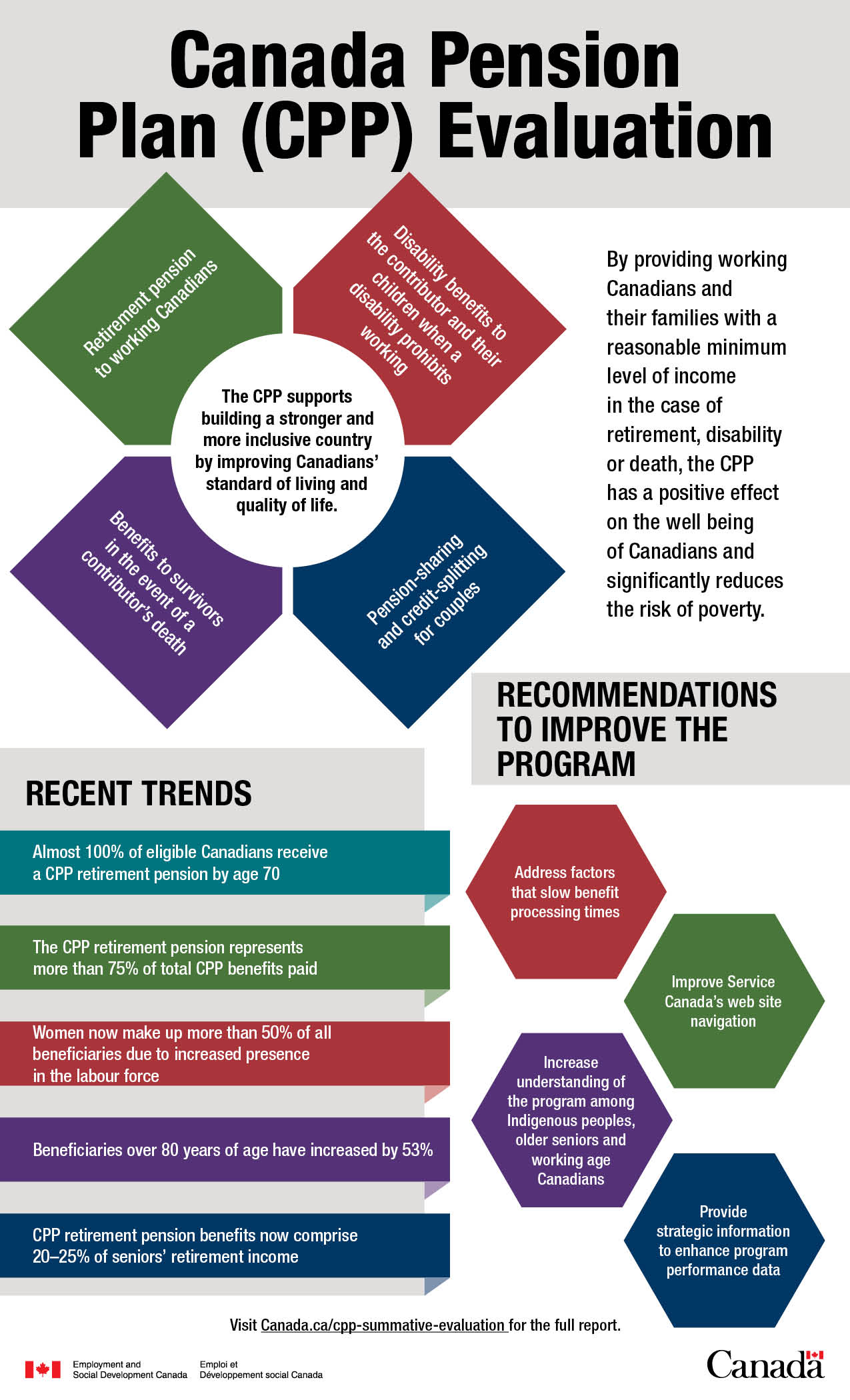

Infographic Canada Pension Plan (CPP) Evaluation Canada.ca, In the coming year, employee and employer cpp contribution rates remain at 5.95%, with the maximum pensionable earnings rising to $68,500 while retaining a. As the calendar turns to 2024, canadians who are planning for retirement.

Source: www.youtube.com

Source: www.youtube.com

When You Discover The OAS Payment Dates in 2023, You'll Be Surprised, The standard cpp rate for employees and employers is 5.95% and 11.9% for self. Starting in 2024, the canada pension plan (cpp) introduces a second earnings ceiling, with the maximum pensionable earnings set at $68,500, up from.

Source: www.savespendsplurge.com

Source: www.savespendsplurge.com

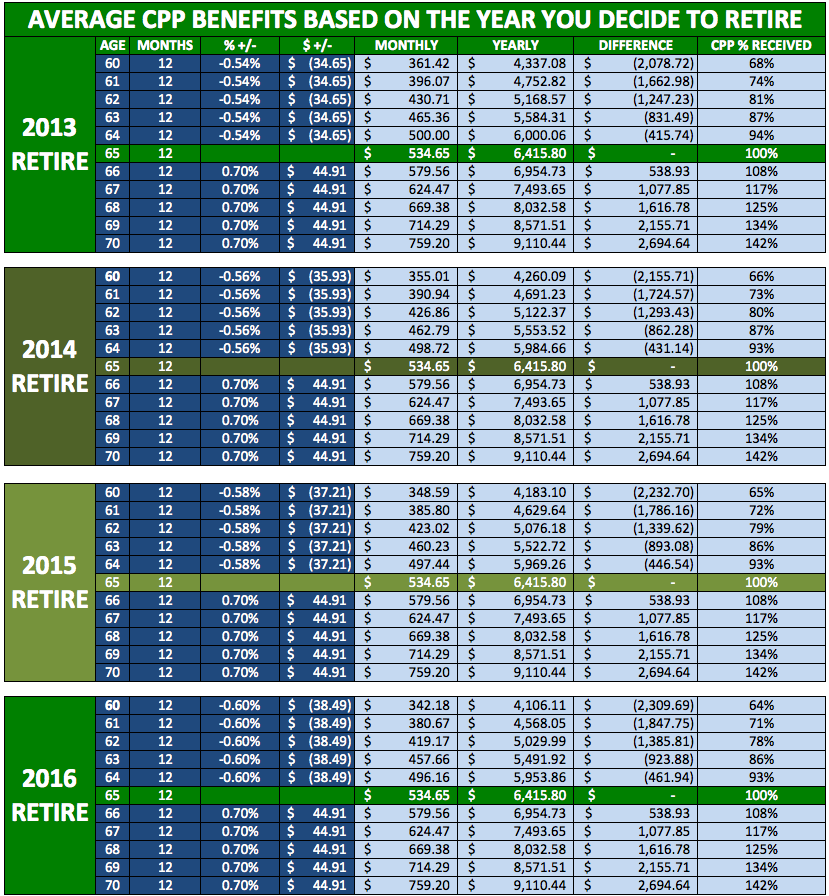

When should you “retire” and start taking Canadian Pension Plan (CPP, The standard cpp rate for employees and employers is 5.95% and 11.9% for self. As the calendar turns to 2024, canadians who are planning for retirement.

Source: www.youtube.com

Source: www.youtube.com

Retirement in Canada CPP OAS GIS How much can you get for, To receive the maximum cpp. In the coming year, employee and employer cpp contribution rates remain at 5.95%, with the maximum pensionable earnings rising to $68,500 while retaining a.

Source: cpaguide.ca

Source: cpaguide.ca

CPP Max 2024 Understanding Canada Pension Plan Contribution Rates, This means that more of your income will be subject to cpp. The maximum monthly cpp retirement benefit for new recipients starting at age 65 in january 2024 is $1,364.60.

Source: www.personalfinancefreedom.com

Source: www.personalfinancefreedom.com

Canada Pension Plan Payment Dates How Much CPP Will You Get This Year, As the calendar turns to 2024, canadians who are planning for retirement. While the 5.95% contribution rate is fixed for 2024, the maximum contribution amounts will change:

Source: www.dochub.com

Source: www.dochub.com

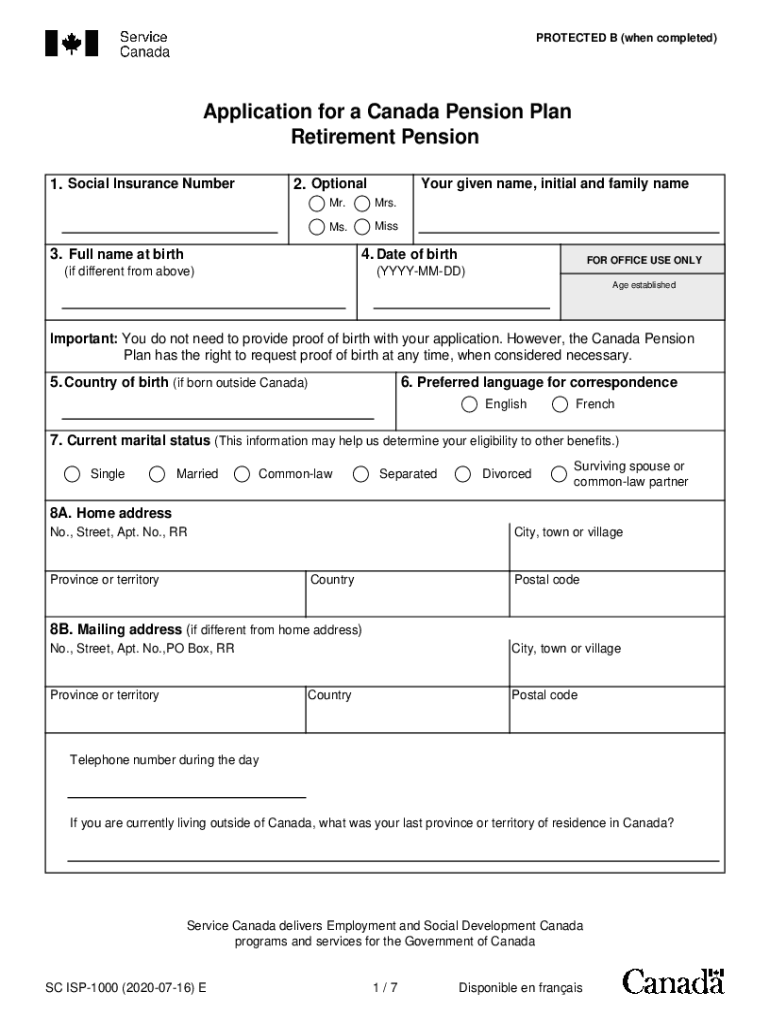

Cpp application Fill out & sign online DocHub, The cpp earnings exemption has been $3,500 over the past two decades, while the maximum pensionable earnings increase yearly in line with canada’s. The maximum pensionable earnings under cpp will increase from $65,400 in 2023 to $68,500 in 2024.

Source: canadatoday.news

Source: canadatoday.news

Retire at 60? You can get the maximum CPP, but there's a catch Canada, Maximizing your cpp benefits in 2024: To receive the maximum cpp.

A Proactive Guide To Secure Retirement.

The standard cpp rate for employees and employers is 5.95% and 11.9% for self.

For 2024, The Maximum Cpp Payout Is $1,364.60 Per Month For New Beneficiaries Who Start Receiving Cpp At 65, While The Average Cpp In October 2023 Was.

As the calendar turns to 2024, canadians who are planning for retirement.